How to trade the morning gappers

We may earn commissions from the companies mentioned in this post. View our FTC disclosure for more information.

Edit 1/25/2022: I launched https://TradeForMe.money recently, and developed a lot of cool stuff. Check it out!

Ever since I began studying day trading I’ve heard of the morning gappers. There’s a ton of content that comes out from the Warrior Trading YouTube channel that shows promising results (and some huge losses) that had me engaged from the very beginning. I began watching that channel from the start, and hanging on every word that Ross Cameron had to say. I took notes, downloaded all of the free content I could, and practiced the Gap & Go strategy in my paper trading account. The truth is, I haven’t had any great success with it. That’s not to say it can’t be done. Obviously it can, and Ross Cameron and many other traders are proof that there’s a lucrative amount of money to be made using that strategy. The trouble for me is that it’s just so damned stressful, and by the time I’ve decided that I need to enter the trade, I realize I never had time to plan a proper stop loss or target. Perhaps I’m too dumb and slow, but I’m just not cut out for it. In this post, I’m going to share with you what I am cut out for, and maybe you’ll find something useful!

Low float, medium float, or large float?

The Gap & Go strategy that Ross Cameron uses and teaches focuses on low float stocks, gapping up on high relative premarket volume, that have a news catalyst. It doesn’t appear that the news must be of any particular interest, good or bad…just that there’s some reason the stock is gapping up. One of the attributes of low float stocks is that since there are fewer shares to trade, demand tends to push price up fast and steep. This volatility is what makes this trade attractive for many. Something I’ve noticed, and I’m sure someone out there could attest to, is that medium float and large float stocks have more predictable price action. That makes them more attractive to me since I can take a little more time deciding if I want to enter a trade, and determining where to place my stop loss and potential target. In terms of float, I prefer the medium float stocks.

The watchlist

Here are the criteria I use to create my watch list every day.

- Last price: $10 – $100

- Minimum of 50,000 shares of volume traded in premarket

- 20,000,001 – 500,000,000 shares

- Price gapping up at least 4% during premarket

Using those criteria, I’m able to return around 10 – 20 stocks each morning (I run my scan right at 9:00EST) to have a closer look at. I sort by highest volume and make my way down the list. I first find stocks that are trading above the 200 period exponential moving average on the daily chart. The gap should, ideally, be taking out a prior pivot high and the stock should not be up more than 4 consecutive days. Once I’ve narrowed the list down to those, I then have a look at the premarket on a 5 minute chart to verify that there’s some real price action occurring. I like to see that there’s real interest in the stock from more than one big player.

Where’s the entry?

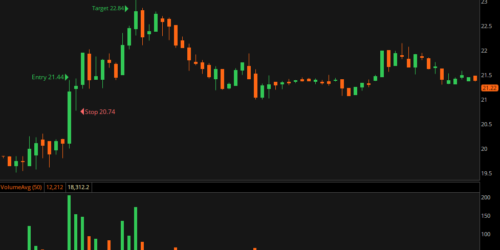

This is the trick, right? Trying to figure out where you have the best probability of making some money, while limiting your downside risk. The way I see it, there are two potential entries on these stocks. The first is a break of the premarket high. Simply put, once a strong stock breaks above this level, there’s often a good risk to reward. The stop goes just below the premarket high, and the take-profit is anyone’s guess. If there’s a prior level of resistance, I would likely use that as my first target. If it hits, I might take half my shares off the table, and move my stop loss up to break even. If there’s nothing but the milky way and moon above the move, you can simply draw a trendline and wait for the first downward break (a candle to close below the trendline) to take your profits.

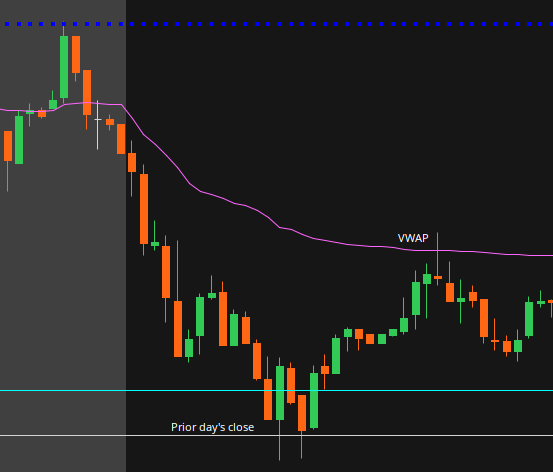

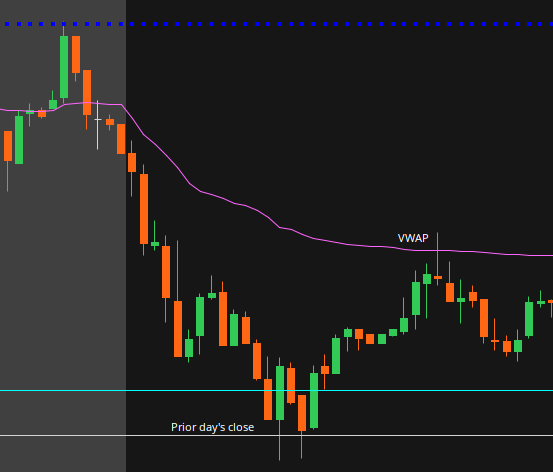

The second trade, and probably my personal favorite (because I have more success with it), is to fade the low. I try to stay out of the first hour of the trading day for this one. I markup the charts with the prior day’s high, low, and close, as well as the premarket high and low. After roughly the first hour, there tends to be a selloff to one of those levels. Remember, a lot of folks woke to a nice gain if they were long in the stock, and they’re taking profits in the morning. If there’s a decent distance between the low and VWAP, I consider a closer look. Once I see a 5 minute candle close above the lowest candle of the morning I consider a taking a trade. I may go long with a stop below the low, and a profit target of the VWAP. This all depends on the risk/reward, of course, so you must use your judgement. You must also feel confident that it has found support at a previous important level. If the setup looks good, but it hasn’t found a prior support level, skip it.

In the following screenshot, the price found support at the prior day’s close, and moved up to the VWAP.

I’m not sure how popular this strategy is, but I like that it’s more predictable than the Gap & Go strategy. Now for the disclaimer. I’m not telling you to do this, I’m not a financial advisor, and I have no affiliation with anyone mentioned in this post. If you find it useful, or just want to start a conversation, please leave me a comment! I would love to talk shop with other day traders!