Average Daily Trading Range is NOT ATR

We may earn commissions from the companies mentioned in this post. View our FTC disclosure for more information.

This is going to be a very short blog post. The concept is painfully simple, and I’m kicking myself for not thinking about it sooner. Before I get into it, please take a moment to check out Life’s a Play. It’s an album I released last year and I would really appreciate your support! I would also love to hear your thoughts on it. If you have time, please send me a message to let me know what you think!

I was today years old when I learned that the ATR indicator I’ve been using in the ThinkOrSwim platform is not an indication of the average daily trading range. The average true range (ATR) is a technical analysis indicator that measures market volatility by decomposing the entire range of an asset price for a given time period. In short, in includes the gaps and everything in between…which I don’t care about. In fact, I really just need a way to sum up the actual average daily trading range over a period so I can estimate where I might like to get in or out of a position. You might think to yourself, “But Mark, why don’t you just look at the daily chart and estimate the average based on the last several days?” The answer is simple. I’m a nerd programmer/musician with nothing better to do than write thinkscripts and make YouTube videos.

For those of you that are interested, the ATR is described in detail on Investopedia. You may find the formula and all the nerdy stuff that goes along with it there. For the rest of you that are only interested in coming up with a relatively safe estimate of where the stock might head during a single trading day, check out the average daily trading range indicator script that I wrote. It’s for sale on my other website for super cheap. I know that many people don’t have time to learn scripting, or don’t want to. I also understand that many people get hyped up over things and are willing to pay too much for them. If you know anything about me from my previous posts, you know I’m a rich person in a poor persons life, lol. I understand financial struggles, poverty, and pain firsthand, and I’ve been digging myself out of the shit rut that I was born into for almost 40 years. Anyway, this post isn’t about me. It’s about helping you stay out of bad trades.

Should I go long?

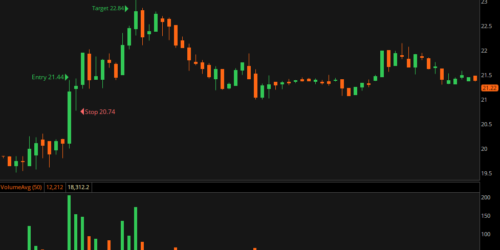

Using the average daily trading range of a particular stock, you can decide this with a bit more objectivity. Has the stock already made a move that equals or exceeds it’s average range? Is the stock trading near that range? If the answer is yes to those questions, then the answer to the first question is NO. Unequivocally, NO, you should not go long. Does that mean that the stock can’t or won’t go higher. It doesn’t mean that at all, but if you’re an odds trader, you’re putting yourself in a lower odds position if you decide to go long.

Maybe I should short it!

The inverse of the above is true. If the stock has already put in a low and high for the day that meets or exceeds that trading range, and the stock is trading near the low of the day, don’t take a short position. Again, this is simply about the odds of success. The last thing you want to do is enter a trade to immediately watch it go against you. Of course, you’re a smart trader, so you have a stop loss order in the system to protect you, but still…it’s painful to enter a trade that stops you out right out of the gate, right?

In summary

Don’t be fooled by a “perfect” pattern just because it’s a pattern. If you could see that you’re taking a position in the direction of support or resistance, you might have some reservations about taking the trade. Using the average daily trading range is an important tool for your trading toolbox, and I hope you find it useful! Best wishes to you and your family, and happy trading!